tax break refund calculator

Of course this presumes you live in a home that appreciates significantly has limited maintenance cost have been living in the home for at. Enter your information for the year and let us do the rest.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Enter your information for the year and let us do the rest.

. These taxpayers may want to review their state tax returns as well. See What Credits and Deductions Apply to You. Fill in the step-by-step questions and your tax return is calculated.

Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. This online calculator will help you see what amount you can expect back in your tax refund. 10200 x 022 2244.

Tax preparation software has been updated to reflect these changes. There are over 22 million qualifying. Wages from a job interest earned Social Security benefits and so on.

For the 202021 and 201920 income years the calculator will estimate your tax payable and calculate your. It can also give you a heads-up if youre likely to owe money. This handy online tax refund calculator provides a.

Deducting home equity debt interest. Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

Up to 10 cash back Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021. Just answer a few simple questions about your life income W2 and expenses and our free tax refund estimator will give you an idea of how much youll get as a tax refund. Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the IRS. Find pros you can trust and read reviews to compare. Estimate the areas of your tax return where needed.

By calculating whether you have overpaid tax due to unused uniform allowance or marriage tax allowance. Calculate Your Potential Income Tax Savings Available Through Home Ownership. How to calculate your unemployment benefits tax refund.

Kiss tax breaks for unemployment benefits goodbye This means households that didnt withhold federal tax from benefit payments or withheld too little may owe a tax bill or get less of a refund. As you make progress the taxes you owe or the refund you can expect to receive will be calculated and displayed on each page. This calculator will help you work out your tax refund or debt estimate.

In 2021 the standard deduction for individuals or married people filing individually is 12550. It can be used for the 201516 to 202021 income years. - Opens the menu.

Both reduce your tax bill but in different ways. HR Block has been helping Americans with their taxes since 1955. So doing a little calculation gives us the following.

Individuals can obtain up to a 250000 profit untaxed while married couples can obtain up to 500000 untaxed. Best online tax calculator. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

People who havent yet filed and choose to file electronically simply need to respond to the related questions when preparing their tax returns. It is mainly intended for residents of the US. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Our calculator limits your interest deduction to the interest payment that would be paid on a 1000000 mortgage. Tax credits directly reduce the amount of tax you owe dollar for dollar.

Tax breaks that directly reduce your tax obligation. Prices to suit all budgets. If you have yet to file your 2020 tax return you can claim the tax break up to 10200 from your taxable income.

Free Federal Tax Calculator. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad Enter Your Tax Information.

The move was taken to help unemployed Americans during the pandemic but not all benefited from it. Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe. Remember this is just a tax estimator so you should file a proper tax return to get exact figures.

This means for there to be tax savings. An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. Income Contingent Loan ICL repayments study and.

This is the refund amount they should receive. Lets say they were on unemployment last year which means their income is somewhere between 9800 to 40000. Ad Real prices from local pros for any project.

Estimate your 2021 taxes. Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States.

The biggest remaining tax advantage of homeownership is tax-free longterm capital gains. If you are married or in a civil partnership you may have missed out on a tax break known as the Marriage Tax Allowance. Tax Refund Calculator can help you claim back what is rightfully yours.

Moving on to another example weve a person and they are single. And is based on the tax brackets of 2021 and 2022. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Single Head of Household Married - Separately Married - Jointly Trust. Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

The standard deduction for a head of household is 18800 the standard deduction for married couples filing jointly is 25100. Information for people who havent filed their 2020 tax return. See How Much You Can Save With Our Free Tax Calculator.

For tax purposes whether a person is classified as married is based on the last day of the tax year which.

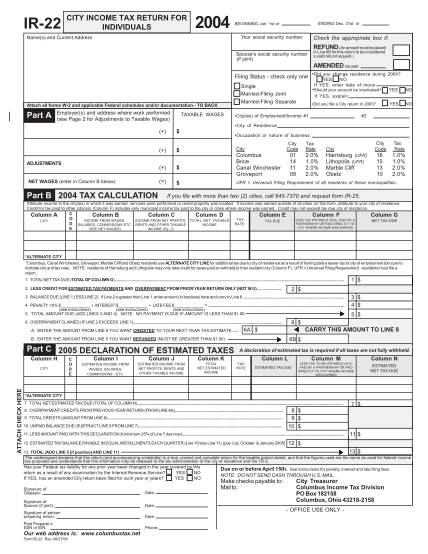

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Top 5 Tax Return Estimators 100 Free

Tax Calculator Estimate Your Income Tax For 2022 Free

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

See Your Refund Before Filing With A Tax Refund Estimator

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

How To Estimate Your Tax Refund Lovetoknow

18 Income Tax Refund Calculator Free To Edit Download Print Cocodoc

Excel Formula Income Tax Bracket Calculation Exceljet

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Try H R Block Tax Calculator 2021 2022 To See Your Refund Amount

Top 5 Tax Return Estimators 100 Free

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

How To Calculate Your Federal Income Tax Refund Tax Rates Org

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Exemptions Deductions And Credits Explained Taxact Blog

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download